Whether they are a financial godsend or a revenue burden to states, production continues to boom because of film incentives and tax credits. However, the challenge for any producer is to stay up to date as incentives are in a constant state of flux… or disappear entirely.

Louisiana was the first state to adopt a tax incentive program for film and television production in 1992 and the strategy took off nationwide. Today, at least 35 states, DC, Puerto Rico, and the U.S. Virgin Islands offer tax incentives for film production.

The good news is that there are lots of options. Many states have an incentive of some kind to encourage you to shoot your project there. However, applying for a tax credit or incentive can be complicated, especially since every state has different rules and regulations to follow.

Film Incentives – Types

While there are six main types of film incentives, they will vary depending on the state.

- Refundable Tax Credit – The state will pay the production company in excess of the company’s owed state tax.

- Non-Refundable Tax Credit – Any amount that remains from the credit is automatically forfeited.

- Transferable Refundable Tax Credit – Can transfer the credit over to a local company so that they can reduce their tax liability.

- Tax Rebate – A refund check issued from the state directly to the production company.

- Grant – Direct payment issued to the production company by the state. Unlike rebates, you do not have to pay any tax on a grant.

- Bonuses – Some states offer additional perks to filmmakers. Such as for using specific locations, local business, or hiring local staff.

Film Incentives – State by State

Below is a list of most of the states that have some type of film incentive program. Please note that programs are always changing. Many states have added to, or tweaked, their incentives for 2023.

Alabama

| Incentive Type | Non Transferable Refundable Tax Credit |

| Website | Alabama Film |

| Minimum Spend | $500,000 |

| Funding Cap | $20,000,000 |

Alabama only offers incentives on the first $20 million of qualifying product expenditures. This means that if your film budget exceeds this amount, only the first $20 million spent in Alabama will qualify for the film tax credit.

Arizona

The Arizona Motion Picture Production Program goes into effect in 2023. To be eligible for the tax credit, producers must shoot their film or television show primarily in Arizona, conduct pre-production and post-production in the state and hire Arizona workers to work as crew on the production.

A 15% tax credit will be provided for productions of up to $10 million, 17.5% tax credit for productions of up to $35 million, and 20% tax credit for productions over $35 million. Production companies will be offered an extra 2.5% tax credit on production labor costs related to positions held by Arizona residents.

The program also provides cash refunds for production companies if the credits are larger than the amount of taxes paid in Arizona.

Arkansas

| Incentive Type | Combination of Tax Credit and Rebate |

| Website | Arkansas Production |

| Minimum Spend | $200,000 |

| Funding Cap | $4,000,000 |

For tax rebates in Arkansas, qualified expenditures include any costs incurred for development, pre-production, production, or post-production of a qualified production. Eligible types of production include animation, documentaries, feature films, pilots, video games, and scripted television. Reality tv, talk shows, game shows, and commercials ARE NOT eligible for any film tax rebate.

Act 797 of 2021 changed the rebate program to allow the incentive to be taken as either a rebate or a transferable tax credit. The Act also added an additional 10% incentive for qualifying veterans, extended the program’s sunset date through June 30, 2032, and set a cap on the tax credit of $4 million per year.

California

| Incentive Type | Non Transferable Refundable Tax Credit |

| Website | Film California |

| Minimum Spend | $1,000,000 |

| Funding Cap | $330,000,000 |

Governor Gavin Newsom’s proposed 2023-24 state budget extends funding for California’s Film and TV Tax Credit Program an additional five years (through fiscal 2030-31) and proposes to make credits refundable for the first time since the state launched its incentive in 2009. The cap remains 20-25% for all crew, depending on the budget. A minimum of 75% of total “principal photography” days must occur wholly in California.

California Tax Credit Program offers bonuses based on the project’s job ratio. These are judged in three different categories that may not be combined: out-of-zone filming, visual effects, and music scoring / track recording labor.

Out-of-Zone Filming Bonus: Determined by the percentage of principle photography days outside of the Los Angeles 30-Mile Zone.

Visual Effects Bonus: Based on services performed in-state. There is no minimum spend requirement.

Music Scoring / Track Recording Labor Bonus: Based on wages paid to scoring musicians and contractors employed solely for the purposes of recording music for the project.

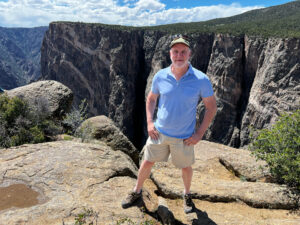

Colorado

Before the pandemic, the Colorado legislature was granting as little as $750,000 a year to the state’s film incentive fund. After lagging behind for so long when it comes to providing film incentives, the Colorado legislature bumped up their film incentive fund in 2023 to $11.25 million.

All production types are eligible for these film industry tax incentives except talk shows, post-only shows, and game shows. However, the only caveat is that 50% of the crew base should consist of Colorado residents to be eligible for the film tax rebate.

Connecticut

All project types are eligible for Connecticut film tax credit, including game shows, talk shows, and reality TV. However, the production company must spend at least $100,000 in the state.

The tax credit the company receives depends on how much they spend in Connecticut. For example, they get a 10% tax credit if their qualifying expenses are between $100,000 and $500,000; 15% for qualifying production expenses up to $1 million; and 30% tax credit if qualifying production expenses exceed $1 million.

Georgia

| Incentive Type | Transferable Refundable Tax Credit |

| Website | Georgia USA |

| Minimum Spend | $500,000 |

| Funding Cap | None |

Georgia’s tax credits continue to be some of the best in the nation. Although a bill to limit tax film credits at $900 million annually was introduced to the legislature in 2022, it failed to pass. Legislators cited concerns of losing film industry business over changes to the current incentive programs.

All projects get a 20% spend. However, they are awarded an additional 10% if they include the made-in Georgia logo in the film’s opening and links to the Georgia website on the project’s landing page.

Illinois

Illinois film incentives include a 30% transferable tax credit on qualified expenditures incurred in the state. Production houses will receive an additional 15% production incentive if they hire individuals from economically disadvantaged areas, where the rate of unemployment is at least 150% of Illinois’s unemployment rate.

Qualified expenditures include tangible, personal property and services purchased from Illinois vendors, and compensation paid to Illinois resident employees.

The new law also expands the program to a $500,000 cap on qualified resident and non-resident wages(for a television series, qualifying non-resident wages are limited to the entire season).

Indiana

| Incentive Type | Non-Transferable Non-Refundable Tax Credit |

| Website | Film Indiana |

| Minimum Spend | N/A |

| Funding Cap | $5,000,000 |

In 2022, Indiana created the state’s first film tax credit program. The Film and Media Tax Credit offers an income tax credit of up to 30% that can be applied to offset certain production expenses, such as acquisitions, filming and sound, labor, and story rights. Additionally, production crews and talent staying in the state for 30 consecutive days or more may be exempt from the County Innkeeper’s Tax, further incentivizing Indiana as a production destination.

Kentucky

| Incentive Type | Non-Transferable Refundable Tax Credit |

| Website | Kentucky Film |

| Minimum Spend | $250,000 |

| Funding Cap | $75,000,000 |

The Commonwealth of Kentucky has revised guidelines for its film incentives program, returning it to refundable credits that were scaled back in 2018. Although the funding cap was reduced from $100 million to $75 million, the state offers a refundable 30-35% tax credit. With the new guidebook, individual projects are capped at $10 million in a calendar year, and a production company can qualify for incentives on a maximum of four projects a year. However, qualified expenditures must be made from businesses within the state.

Louisiana

| Incentive Type | Non-Transferable, Partly Refundable Tax Credit |

| Website | Louisiana Entertainment |

| Minimum Spend | $300,000 |

| Funding Cap | $150,000,000 |

Attempts to both scale back and extend the life of the tax credit in 2022 failed in the state legislature, leaving the status quo in place. Louisiana continues to offer productions with up to a 40% tax credit on eligible expenditures. All production types are eligible for the Louisiana film tax credits, including reality shows, video games, and commercials. However, the production company should spend at least 25% of its budget in Louisiana.

Maryland

| Incentive Type | Non-Transferable Refundable Tax Credit |

| Website | Maryland Film |

| Minimum Spend | $250,000 |

| Funding Cap | $12,000,000 |

Since inception of the Film Production Activity Tax Credit program in 2011, Maryland has incentivized major productions that employed thousands of residents, utilized thousands of local small businesses, and generated an economic impact of nearly $1 billion in the state. Scripted television, feature films, pilots, and commercials are eligible for film tax credit in Maryland. However, 50% of the principal photography must be in the state to receive the tax breaks.

Massachusetts

| Incentive Type | Transferable, Partly Refundable Tax Credit |

| Website | MA Film |

| Minimum Spend | $50,000 |

| Funding Cap | None |

Massachusetts provides filmmakers with a highly competitive package of tax incentives: a 25% production credit, a 25% payroll credit, and a sales tax exemption. Animations, commercials, documentaries, pilots, feature films, reality TV, and scripted television are eligible for film tax credit in the state. Game shows, talk shows, and video games are not eligible. Production companies must spend 25% of their budget in the state to receive the film production tax credits.

Minnesota

| Incentive Type | Tax Rebate |

| Website | MN Film TV |

| Minimum Spend | $100,000- $1,000,000 |

| Funding Cap | None |

Minnesota started offering a transferable tax credit for film and TV production in 2022. The rebate reimburses up to 25% of eligible production expenditures. All production types are eligible in Minnesota for incentives, except for game shows, talk shows, and video games. In 2023, productions applying for Minnesota’s Film Production Tax Credit will be eligible for more credit than previously offered because the compensation cap for above-the-line wages is increasing from $100,000 to $500,000.

Mississippi

All production types are eligible for Mississippi film incentives except for game shows and talk shows. Qualified expenditures include production costs paid to Mississippi vendors and companies.

Local residents earn a 30% tax incentive, and local veterans get an additional 5%. All non-residents earn 25%. However, a prerequisite is that at least 20% of the production crew must be residents of Mississippi.

Montana

| Incentive Type | Transferable Non-Refundable Tax Credit |

| Website | Montana Film |

| Minimum Spend | $350,000 |

| Funding Cap | $12,000,000 |

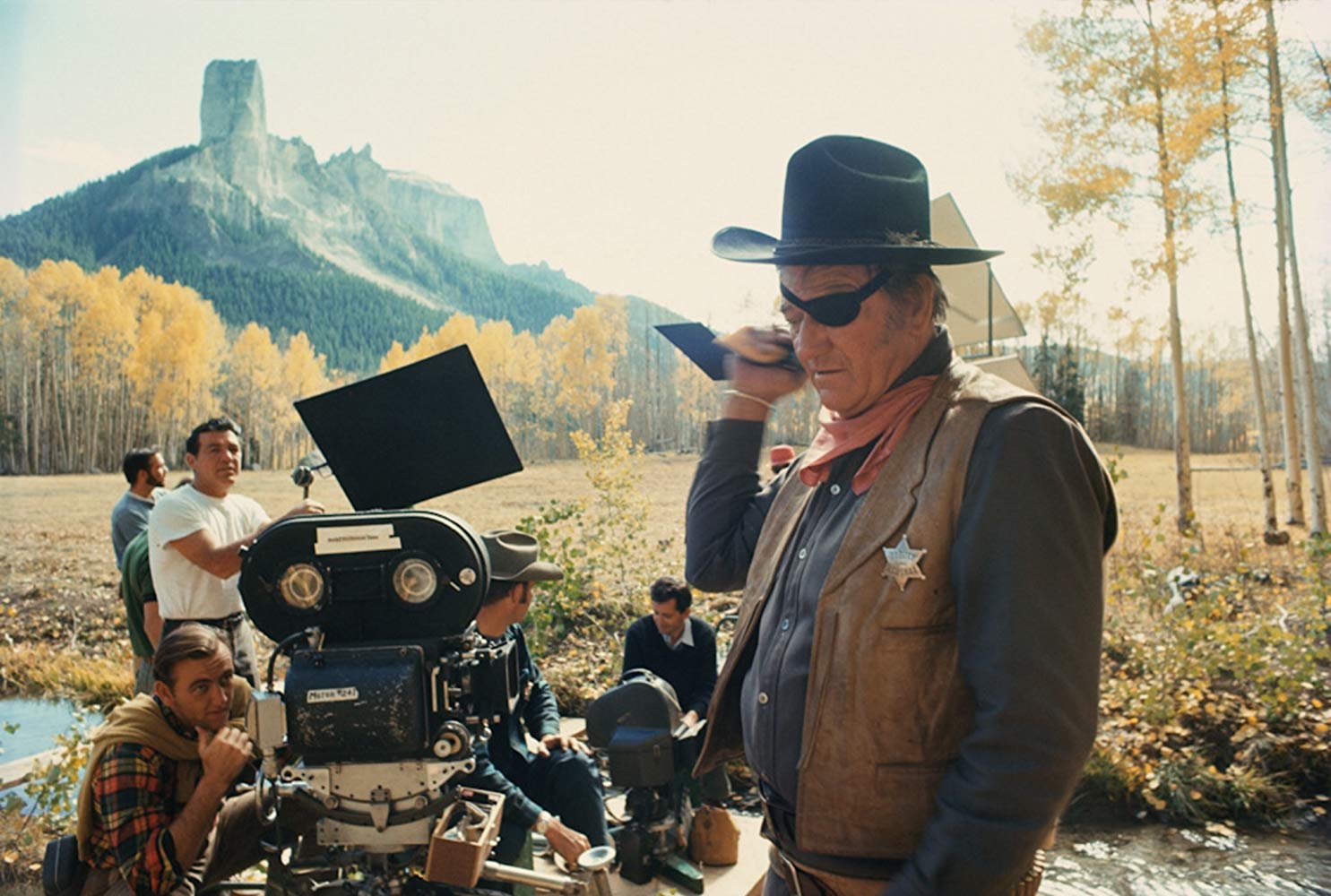

The power of film incentives was on display for every producer to see when Yellowstone, the hugely successful Paramount Network series starring Kevin Costner, stopped filming in Utah in 2021 and moved to Montana due to better incentives. Animation, commercials, feature films, pilots, scripted television, and video games are all eligible for the tax credit. Documentaries, reality television, game shows, and talk shows are not eligible. To qualify, 50% of all principal photography must take place in the state.

A 5% extra tax incentive is given if the production company uses “Film Montana” on the screen credits.

Nebraska

Nebraska dipped their toe into the water on film incentives back in 2021. The program set aside $1 million for incentives for feature films shot on location in Nebraska and tell a Nebraska story. Feature films are the only projects eligible. Films must use Nebraska workers, and spend at least $1 million filming in the state, to qualify for the grants.

Nevada

| Incentive Type | Transferable Non-Refundable Tax Credit |

| Website | Nevada Film Office |

| Minimum Spend | $500,000 |

| Funding Cap | $10,000,000 |

All production types are eligible for the Nevada tax incentive. Companies are eligible to receive a 15% credit of the qualified production expenditures plus an additional 5% if more than 50% of the production’s below-the-line personnel are Nevada residents. Qualified expenditures include pre-production, production, and post-production expenditures, such as compensation and wages, purchases, and rentals of products or services from any local business. However, at least 60% of the production budget must be spent in Nevada.

New Jersey

| Incentive Type | Transferable Non-Refundable Tax Credit |

| Website | NJ Motion Picture |

| Minimum Spend | $1,000,000 |

| Funding Cap | $100,000,000 |

Film and TV production spending in New Jersey topped $650 million in 2022, reflecting the Garden State’s efforts to woo Hollywood productions with incentives. Lionsgate and Netflix have both recently announced large studio production facilities coming to the state and will soon join the 29 studios already in New Jersey. Under the film tax break program, the state compensates producers 30% of qualified digital media production expenses, or 35% of qualified digital media production expenses incurred for filming scenes in New Jersey and buying in-state goods.

The state’s also offers a Diversity Tax Credit Bonus of 2% or 4% for plans to hire women and minorities for key creative positions and production crews.

New Mexico

| Incentive Type | Transferable Non-Refundable Tax Credit |

| Website | New Mexico Film Office |

| Minimum Spend | None |

| Funding Cap | None |

New Mexico film industry had another record year in 2022 with a direct spend of $855.4 million to the state and a record 109 productions… largely due to production tax incentives. One of the first states in the U.S. to offer incentives to the industry, New Mexico offers a refundable tax credit of 25% for spending on state film crews, goods, services and other eligible expenses. The rate can be as high as 35%, depending on where it’s filmed, among other factors.

The 25% tax incentive is also applicable to nonresident talent, given certain criteria are met. New Mexico does not have a minimum spend and all production types are eligible, which makes it even more attractive to independent productions.

New York

| Incentive Type | Non Transferable Refundable Tax Credit |

| Website | Empire State Development |

| Minimum Spend | $250,000 |

| Funding Cap | $420,000,000 |

Production companies may be eligible to receive a fully refundable credit of 25 percent of qualified production costs and post-production costs incurred in the state. There is a maximum of $5 million per year that can be allocated for the additional 10% credit on qualified labor expenses. The New York Commercial production incentive allows for online commercials to qualify as well, a boon for branded content companies.

North Carolina

| Incentive Type | Tax Rebate |

| Website | Film NC |

| Minimum Spend | $1,000,000 |

| Funding Cap | $31,000,000 |

North Carolina has a strong history with the entertainment industry with incentive programs dating back to 2014. However, the program is evolving as the 2023 state budget adjusts the financial qualifications TV and film projects must meet in order to receive financial incentives from the state.

North Carolina has reduced minimum spend requirements for tv and movie projects and increased their spending caps with close to $30 million available in funding. The 25% rebate is available for “qualifying expenses and purchases made by productions while in-state.”

Oklahoma

| Incentive Type | Tax Rebate |

| Website | OK Film |

| Minimum Spend | $25,000 |

| Funding Cap | $30,000,000 |

In July of 2021, the state launched a new film incentive program that’s nearly quadruple the size of its current program. It’s part of a vision by lawmakers to turn the Sooner State into a production powerhouse. The program offers film and TV productions up to a 38% rebate on money they spend in Oklahoma.

Oklahoma’s base cash rebate is 20% and productions can increase the amount with boosts meant to spur long-term investment in the state. For example, there’s a 2% bonus for TV pilots and a 5% bonus for a full TV series season. There’s also a 5% boost for production companies that commit to making three films in three years. There’s an additional boost as well for filming in rural Oklahoma or a soundstage as well as doing post production work in the state.

Oregon

The Oregon Office of Film and Video sets itself apart through its commitment to a more inclusive, diverse film and entertainment industry. The office is championing initiatives in affirmative action and DEI, environmentally-conscious content creation and equitable hiring practices. They offer qualifying film or television productions a 16% cash rebate to in-state residents and a 10% cash rebate to non-residents. The state also offers two bonus programs under their Oregon Production Investment Fund:

Within the Portland Metro Area: Allows a reimbursement of up to $200/day for each person traveling to or being put up at a different location. This has a project cap of $50,000.

Outside the Portland Metro Area: Allows for an additional 10% to be added to the project’s overall award.

Pennsylvania

| Incentive Type | Transferable Non-Refundable Tax Credit |

| Website | Film in PA |

| Minimum Spend | $100,000 |

| Funding Cap | $70,000,000 |

Pennsylvania has been home to many film, television and commercial productions including Rocky, The Dark Knight Rises, Silver Linings Playbook, Transformers, The Office, and It’s Always Sunny in Philadelphia. The state offers a 25% tax credit to productions that spend at least 60% of their total budget in the Commonwealth.

All production types except video games are eligible for the tax credit. All crew earn a 25% tax credit, and a bonus of 5% is given if stage filming requirements are met. Qualified expenditures include pre-production, production, and post-production costs incurred in the state.

Rhode Island

| Incentive Type | Transferable Non-Refundable Tax Credit |

| Website | RI Film and TV Office |

| Minimum Spend | $100,000 |

| Funding Cap | $20,000,000 |

Rhode Island provides a Motion Picture Production Tax Credit of 30% for state certified production costs incurred directly attributable to activity within the state. To qualify, the production needs to be shot primarily in Rhode Island, meaning that 51% of principal photography must take place in the state. While there is $7 million cap per project, that can be waived for qualifying motion picture and TV productions.

Animation, commercials, documentaries, and music videos are eligible for the tax credit. Qualified expenditures include pre-production, production, and post-production costs incurred in the state.

South Carolina

| Incentive Type | Tax Rebate |

| Website | SC Film |

| Minimum Spend | $1,000,000 |

| Funding Cap | $17,000,000 |

South Carolina has been the backdrop for more than 100 feature films, 100+ TV movies, series and pilots, going back to the Edison’s The Southerners in 1914. The state offers a 25% tax rebate to film productions that spend $1 million within 12 months and at least $1 million per episode for a TV series.

Animation, commercials, documentaries, and music videos are eligible for the tax rebate. Unlike many other states, the South Carolina rebate is not first come first serve. Projects are evaluated for how much they will benefit the state by hiring South Carolina crew, using local suppliers, being bonded and insured, and having a distribution plan.

Tennessee

Tennessee offers productions a cash rebate in the form of a 25% grant on all Tennessee labor, production services and music for qualified, in-state expenditures. Qualified expenditures include pre-production, production, and post-production costs incurred in the state. As an interesting side note, companies must post a notice in local newspapers where the filming took place after principal photography, telling the public of the need to file creditor claims.

Texas

While many TV shows and films set in the Lone Star State are not actually filmed there because surrounding states offer more attractive incentives, Texas is trying to change the narrative. If the new bill, introduced in the Texas state legislature on March 7, is passed, productions will be eligible for 30 to 42.5% tax credits on in-state spending with no cap. That’s a significant increase from the existing incentive program, where film and TV projects may qualify for a cash grant of only 5% to 22.5% of eligible spending. Qualified expenditures include payments made to Texas companies for goods and services directly used or related to production.

Utah

| Incentive Type | Tax Credit and Rebate |

| Website | Film Utah |

| Minimum Spend | $500,000 |

| Funding Cap | $20,000,000 |

While the state did lose Yellowstone to Montana because of film incentives, Utah has a solid incentive program. The Motion Picture Incentive Program (MPIP) is a 20% to 25% incentive that offers a cash rebate or fully refundable, non-transferable tax credit on qualified dollars left in the state of Utah. Narrative, documentary, and episodic series that intend to be distributed commercially are eligible.

Utah also offers the Community Film Incentive Program (CFIP), a 20% cash rebate specifically for projects that originate in Utah with budgets between $100,000 – $500,000. The CFIP is designed as a platform to foster new and up-and-coming local filmmakers and productions.

Virginia

| Incentive Type | Tax Credit and Grant |

| Website | Virginia Film Office |

| Minimum Spend | $250,000 for tax credit. None for grant. |

| Funding Cap | $6,500,000 for tax credit. $3,000,000 for grant. |

Virginia has two different incentive funds – the Motion Picture Opportunity Fund provides grants, and the Virginia Motion Picture Tax Credit Fund provides refundable tax credits. To be eligible for the tax credit, a production company must shoot at least 50% of principal photography in the state and spend at least $250,000 in qualifying expenses in Virginia. There is no minimum spend for the grant program.

Qualified expenditure for the incentives includes expenses made in Virginia in the form of services or products, including leased products.

Washington

| Incentive Type | Tax Rebate |

| Website | Washington Filmworks |

| Minimum Spend | $500,000 for motion pictures, $300,000 per episode, $150,000 for commercials |

| Funding Cap | $15,000,000 |

Washington has continued its dedication to developing entertainment production this year with a budget increase to their Motion Picture Competitive Program. In 2022, they increased the amount of film tax credits that could be awarded annually from $3.5 million to $15 million. This program also expands incentives for projects filming in rural jurisdictions, projects that tell stories of marginalized communities and projects created by people from marginalized communities.

Wrap Up

Although film incentives can be intimidating at first, the benefits are obvious. You can save a lot of money on your production by applying for one. The cost of production is always an issue and producers need to keep them in mind while budgeting. States want you to choose their location over others, so don’t be afraid to send them over any questions. If you need help with your application, reach out to the individual state film commissions where you’re interested in shooting.